Mortgage delinquencies in the U.S. edged slightly higher in June, driven by localized pressure points, though national levels remain historically low, according to new data from Cotality, a leading property information and analytics provider.

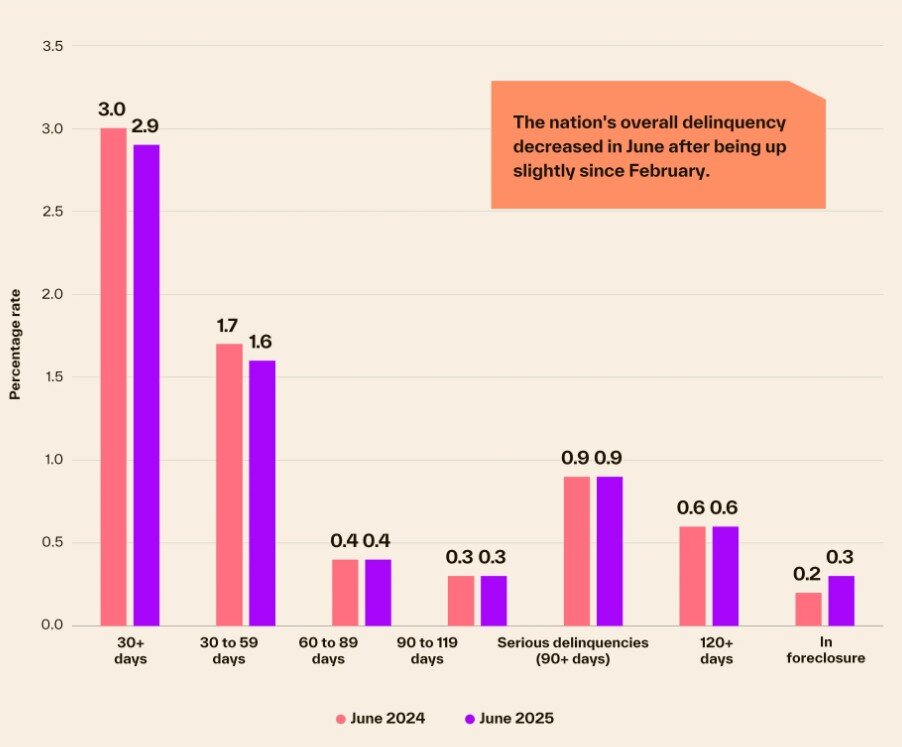

Cotality’s latest Loan Performance Indicators report shows that 2.9% of U.S. mortgages were at least 30 days past due, including loans in foreclosure, down modestly from 3% in June 2024 but up from 2.8% in the first quarter of 2025.

“While the national delinquency rate inched up to 2.9%, it remains below December’s peak of 3.2%,” said Molly Boesel, senior principal economist at Cotality. “Serious delinquencies are holding in a narrow band between 0.8% and 1%, and the transition of loans from current to 30 days delinquent was largely unchanged from the previous quarter. Regional pockets, however, are showing early signs of stress, and rising unemployment could put additional pressure on borrowers.”

Despite minor increases, the U.S. foreclosure rate remains stable, hovering between 0.2% and 0.3%, suggesting most homeowners are avoiding severe payment disruption.

Delinquency Breakdown

- Early-stage delinquencies (30-59 days past due): 1.6%, down from 1.7% a year earlier.

- Adverse delinquencies (60-89 days past due): 0.4%, unchanged from June 2024.

- Serious delinquencies (90+ days past due, including foreclosure): 0.9%, stable from last year and down sharply from 4.3% in August 2020.

- Transition rate (mortgages moving from current to 30 days past due): 0.6%, down from 0.9% in June 2024.

Regional Highlights

Several states and metropolitan areas are showing elevated delinquency trends. The District of Columbia recorded the largest annual increase at 0.6 percentage points, followed by Florida, California, Minnesota, Oregon, Utah, Wisconsin, and Georgia (all up 0.1 percentage points). Most other states saw minor declines or no change.

Among U.S. metros, 104 out of 384 reported year-over-year increases in overall delinquency. Farmington, New Mexico, posted the largest jump, up 1 percentage point, followed by Sebring-Avon Park, Florida (+0.7 points) and Beckley, West Virginia (+0.6 points). Serious delinquency increases were most pronounced in Asheville, North Carolina (+0.6 points), as well as Lawton, Oklahoma; Tampa-St. Petersburg-Clearwater, Florida; Lakeland-Winter Haven, Florida; Wichita Falls, Texas; Punta Gorda, Florida; and Augusta-Richmond County, Georgia-South Carolina (+0.5 points each).

Cotality’s comprehensive analysis of delinquency stages provides a granular view of mortgage performance and highlights how national averages can mask localized stress. While overall U.S. mortgage health remains resilient, experts caution that targeted economic pressures could challenge borrowers in the months ahead.