Image credit: Getty Images

The UAE Ministry of Finance has issued Cabinet Decision No. (197) of 2025, unveiling a revamped structure for selective goods taxation, including revised rates and methods for calculating the selective price. The latest decision marks a significant update to the country’s excise tax framework, with a particular focus on introducing a “tiered volumetric model” for sweetened beverages.

The new decision replaces Cabinet Resolution No. (52) of 2019 and its subsequent amendments, according to a WAM report.

Read more-UAE launches Advertiser Permit: New rules every brand should know

The amendment aligns with ongoing national efforts to promote public health and encourage healthier consumption patterns. It follows the recent revisions to Federal Decree-Law No. (7) of 2025 on excise tax, reinforcing the UAE’s commitment to reducing sugar-related health risks and building a more transparent tax environment.

Officials said the updated framework seeks to unify legislative guidelines governing excise goods, offering clearer definitions and more straightforward tax calculations. The move is designed to help taxable businesses better understand and fulfill their obligations while also supporting the country’s long-term health objectives.

Tax rates tied to sugar content

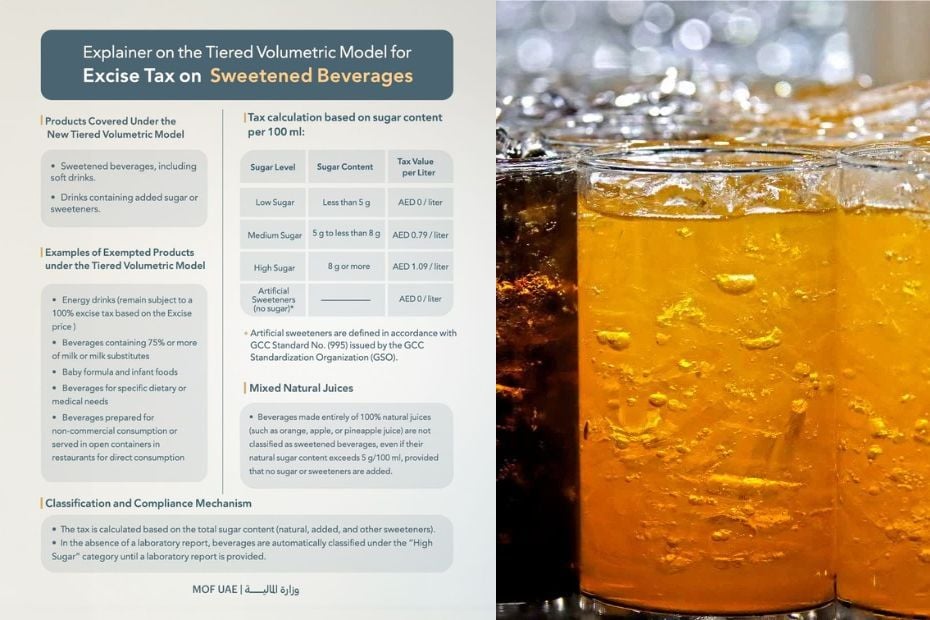

Under the new tiered model, excise tax on sweetened beverages will be directly linked to sugar concentration per 100 millilitres. Beverages containing 5 grammes or more but less than 8 grammes of sugar per 100 millilitres will incur a tax of Dhs0.79 per litre. Those with 8 grammes or more of sugar per 100 millilitres will be taxed at Dhs1.09 per litre.

Products with less than 5 grammes of sugar per 100 millilitres, as well as beverages containing only artificial sweeteners, will be exempt from excise tax, reflecting the government’s intention to encourage healthier consumer choices.

Compliance and classification measures

The resolution also details the Federal Tax Authority’s procedures for product classification, including their addition to the official price list. Taxable persons who fail to provide necessary laboratory reports or supporting documents will temporarily be subject to the highest sugar-content tax tier until appropriate certifications are submitted. Once verified, tax assessments may be revised.

All amendments tied to the tiered volumetric model are scheduled to take effect on January 1, 2026.

The Ministry of Finance emphasised that the new measures support the government’s broader agenda to reduce healthcare burdens associated with high sugar consumption while strengthening a clear, unified, and investor-friendly excise tax framework.