Tokyo and Seoul drive uptick; Office investment surges 42% quarter-on-quarter

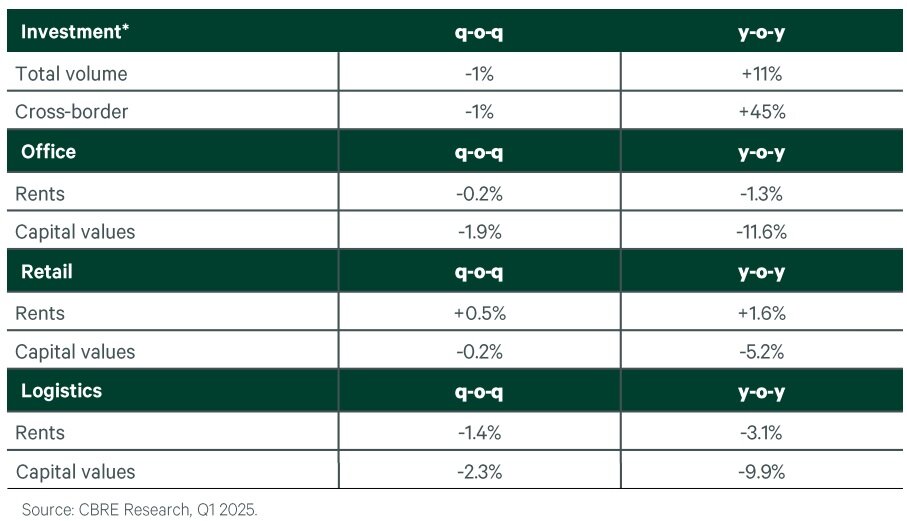

Asia Pacific’s commercial real estate (CRE) investment market held firm in the first quarter of 2025, with total transaction volume reaching $32.8 billion — a marginal 1% dip from the previous quarter but up 11% year-over-year, according to new data from CBRE.

The Q1 results were buoyed by a noticeable pickup in activity in Japan and South Korea, where deal volumes climbed, contributing significantly to regional momentum. The office sector led the resurgence, with investment surging 42% quarter-on-quarter, driven largely by concentrated transactions in Japan.

Office Market Leads the Charge

Grade A office net absorption rose 25% year-over-year to 17.2 million square feet in Q1, supported by strong upgrading and relocation demand across several Asian markets. Financial services and technology firms remained the key drivers of demand. Regional vacancy rates dropped by 0.4 percentage points to 18.5% as most markets reported declines, while rents held steady from the previous quarter.

“The office leasing market in Asia Pacific witnessed a strong first quarter in 2025, driven by robust upgrading and relocation demand,” said Ada Choi, Head of Research, Asia Pacific at CBRE. “The investment market remains healthy as interest rates in most APAC markets continue to decline. However, short-term sentiment may be tempered by uncertainty around evolving U.S. trade policies.”

Richard Stevenson, CBRE’s Head of Office Occupier Services in Asia Pacific, added, “We’ve seen a moderate uptick in leasing enquiries and site inspections this quarter. Landlords in Japan and India are gaining stronger leverage in negotiations, though early planning continues to create tenant opportunities in select submarkets.”

Retail Sentiment Remains Upbeat

Retail leasing across the region stayed resilient in Q1 2025. Tenant interest and site inspections rose, particularly from food and beverage operators — the sector’s primary demand driver. Vacancy remained largely flat, and regional rents edged up by 0.5% compared to the previous quarter.

Logistics Faces Mixed Signals

The logistics sector recorded steady leasing volumes in major APAC markets, but new supply and ongoing global trade uncertainties prompted occupiers to take a more cautious stance. Leasing activity was concentrated among domestic third-party logistics providers (3PLs), fast-moving consumer goods (FMCG) companies, and retailers. Vacancy levels continued to rise amid new project completions.

“Leasing activity has shown modest improvement, largely driven by demand from 3PLs and e-commerce players,” said Michael Bowens, Managing Director and Head of Industrial & Logistics, Advisory & Transaction Services, Asia Pacific at CBRE. “Still, some occupiers are delaying decisions as they assess the impact of recent global trade shifts.”