APAC commercial markets dive into downward rate cycle

Asia-Pacific’s commercial real estate sector is showing fresh signs of momentum, lifted by a favorable mix of cyclical recovery, structural tailwinds, and an emerging global rate-cutting cycle that is reviving investor confidence.

Total investment volume in the region climbed 16% quarter-over-quarter to $38.1 billion in the third quarter of 2025, according to CBRE, marking one of the strongest quarterly rebounds in recent years. Japan, India, and Singapore led the upturn, each recording sharp gains in cross-border and domestic deal activity.

The findings, detailed in CBRE’s newly released 2025 Asia Pacific Investment Strategies Report, highlight how investors are positioning to take advantage of cyclical dislocations and long-term structural shifts across the region’s property markets. “Both pricing and performance are poised to rebound over the medium term,” the report noted, pointing to selective buying opportunities across sectors.

Office Markets Show Selective Strength

Office assets in India, Australia, and Japan are emerging as attractive entry points for investors seeking rental growth and stability. Core buildings near public transport and urban amenities are drawing heightened demand, even as occupier preferences continue to diverge between centralized and decentralized districts.

Logistics and Industrial Assets Lead the Cycle

Investor appetite remains particularly strong for industrial and logistics properties–especially in Southeast Asia and India, where rising manufacturing activity is spurring space demand. In South Korea, “dry logistics” facilities continue to be a favored target for institutional buyers. Expanding e-commerce penetration across emerging markets is adding further fuel to the sector’s momentum.

Retail Market Gains Modest Ground

Retail property performance remains uneven, tempered by global trade headwinds and cautious consumer sentiment. However, CBRE expects rental growth to continue into 2025 and 2026, supported by localized drivers: population growth and monetary easing in Australia; resilient tourism flows offsetting sluggish consumption in Japan and Korea; and strong leasing demand from domestic retailers in India.

Residential and Living Sectors Draw New Capital

Investor demand for the living sector–including multifamily, build-to-rent, and student accommodation–is accelerating despite the relatively small scale of this asset class in Asia-Pacific. Japan continues to attract capital due to low vacancies and favorable cash-on-cash yields, while Australia and Hong Kong SAR are seeing rising interest in development projects aimed at easing housing shortages.

Data Centers Emerge as Core Institutional Play

Data centers are cementing their position as a core real estate asset class across the region, underpinned by surging AI adoption and digital infrastructure demand. CBRE expects supply to lag demand across most major markets, keeping pressure on valuations and yields. Prime opportunities remain in Japan, Australia, and Korea, where operators are recycling assets, while Southeast Asia continues to draw joint-venture development capital.

Overall, Asia-Pacific’s shifting investment landscape — one where declining interest rates, evolving occupier trends, and accelerating digital transformation are aligning to create new opportunities across the commercial property spectrum.

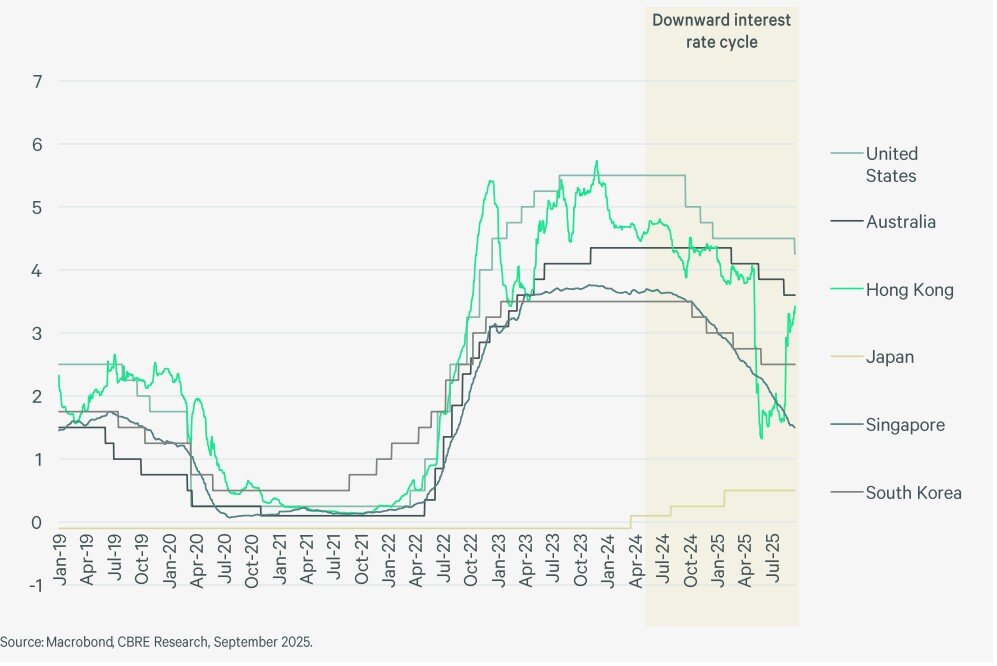

Most markets in Asia Pacific are in the downward interest rate cycle

Interest rates across most Asia-Pacific markets declined through the first half of 2025, with the pace of monetary easing surpassing expectations in several economies–a shift that has begun to breathe new life into the region’s commercial real estate sector.

The drop in borrowing costs has reignited investor appetite, with positive carry returning across many markets and property types. Analysts say the trend is particularly evident in Australia, New Zealand, Singapore, and South Korea, all of which are now largely operating in positive carry territory after a prolonged period of tightening.

The more accommodative rate environment has also opened the door for refinancing activity, giving investors who had been under pressure from elevated Interest Coverage Ratios (ICRs) a chance to restructure loans taken out during the high-rate cycle.

Still, lower interest rates haven’t fully solved the region’s financing bottlenecks. Developers in several markets continue to struggle to secure traditional bank funding for new projects, prompting a surge of interest in private credit. According to data from PERE, roughly $22 billion in commercial real estate debt funds has been raised between 2024 and 2025 to fill the gap left by retreating lenders.

As borrowing costs ease further, analysts warn that the window for opportunistic property acquisitions could narrow. With refinancing now a more attractive option, more asset owners are choosing to restructure debt rather than sell into a recovering market–potentially tightening deal flow in the quarters ahead.