U.S. homeowners lost a portion of their pandemic-era wealth gains in the third quarter as cooling home prices and heavier leverage began to erode equity, according to a new report from property data firm Cotality.

Total borrower equity in mortgaged homes fell $373.8 billion from a year earlier, a decline of 2.1%, leaving aggregate net equity at $17.1 trillion, Cotality said in its third-quarter Homeowner Equity Report. While the level remains historically high, it marks a clear retreat from the peak near $17.7 trillion reached in the second quarter of 2024. Since then, equity levels have oscillated as the housing market adjusts to slower price growth following the pandemic-era surge.

“The market is recalibrating,” said Selma Hepp, Cotality’s chief economist. “As price appreciation moderates and affordability pressures persist, equity dynamics are shifting — particularly for recent buyers who entered the market with low down payments or layered financing.”

The pullback follows several years of outsized gains. Homeowners added roughly $25,000 in equity on average in 2023 and another $4,900 in 2024. Over the past year, however, U.S. homeowners lost an average of $13,400 in equity as price corrections in some regions coincided with higher levels of equity extraction and increased leverage among newer borrowers.

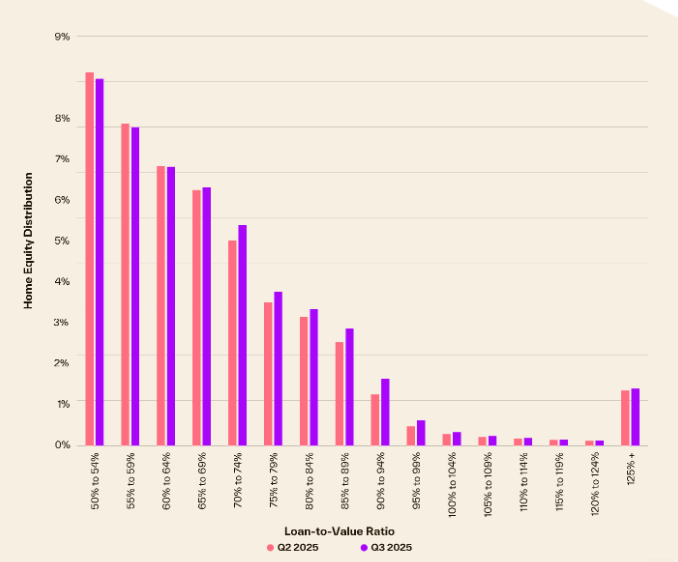

Those trends are pushing loan-to-value ratios higher across the country. Cotality reported a notable increase in the share of homeowners with LTVs between 85% and 94%, a cohort that is more vulnerable to even modest declines in home prices.

Negative equity also ticked higher in the third quarter after briefly easing earlier in the year. About 2.2% of mortgaged homes — roughly 1.24 million properties — are now underwater, meaning borrowers owe more than their homes are worth. That represents a 21% increase from a year earlier, with 216,000 additional homes falling into negative equity, underscoring growing stress among the most highly leveraged households.

Compared with the second quarter, the number of properties in negative equity rose 6.7%, a seasonal pattern that emerged as the spring homebuying season gave way to the slower fall market, when price momentum typically softens.

Looking ahead, Cotality expects the share of underwater homes to remain relatively stable. Its analysis shows that a 5% rise in home prices would restore equity to about 168,000 properties, while a 5% decline would push approximately 319,000 more homes into negative equity. The firm’s Home Price Index forecasts national home prices to rise just over 4% by October 2026 — not enough to significantly reverse recent leverage trends.

The performance of highly leveraged loans will hinge on broader economic conditions, particularly the labor market, Hepp said. While expectations for continued, albeit slower, price appreciation remain intact, she cautioned that these loans warrant close monitoring in the months ahead.

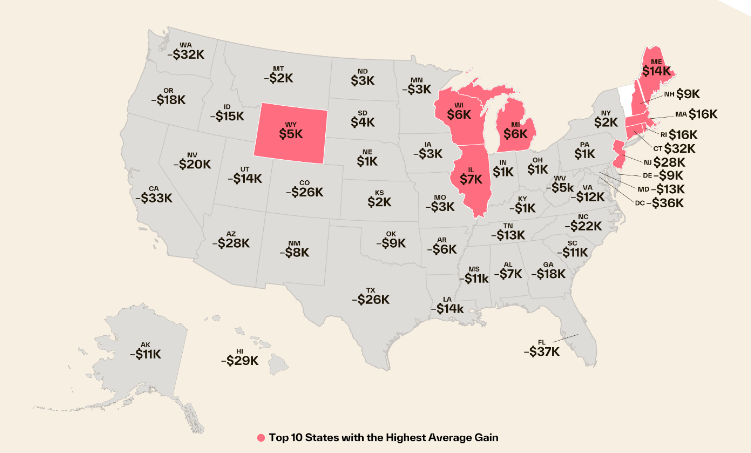

Regionally, equity gains are becoming more uneven. Homeowners in the Northeast continued to post year-over-year increases as home prices there outperformed much of the country. Connecticut led with average equity gains of about $31,500, followed by New Jersey at $27,500 and Rhode Island at $16,200, though gains in each state were smaller than in the prior quarter.

By contrast, 32 states recorded annual equity losses. Florida posted the largest decline, with homeowners losing an average of $37,400 in equity, followed by the District of Columbia at $35,500 and California at $32,500.

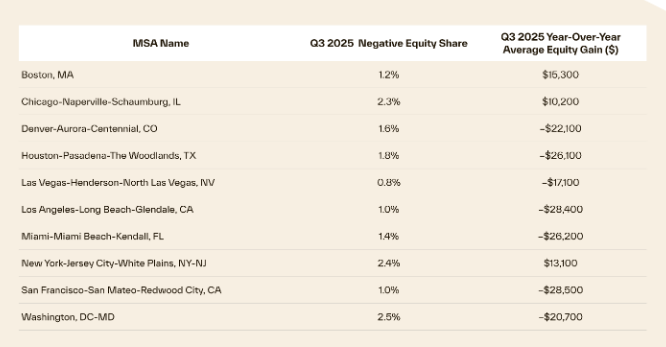

At the metropolitan level, negative equity remains relatively limited in large, high-cost markets such as Las Vegas, Los Angeles and San Francisco. Sharper increases have been recorded in cities including Austin, Texas, as well as Baton Rouge, New Orleans and Lafayette in Louisiana — markets where falling home prices and, in some cases, natural disasters have eroded homeowner equity.

The data suggest the U.S. housing market is settling into a more fragile equilibrium, with still-elevated aggregate equity masking rising vulnerability among recent buyers and highly leveraged households.