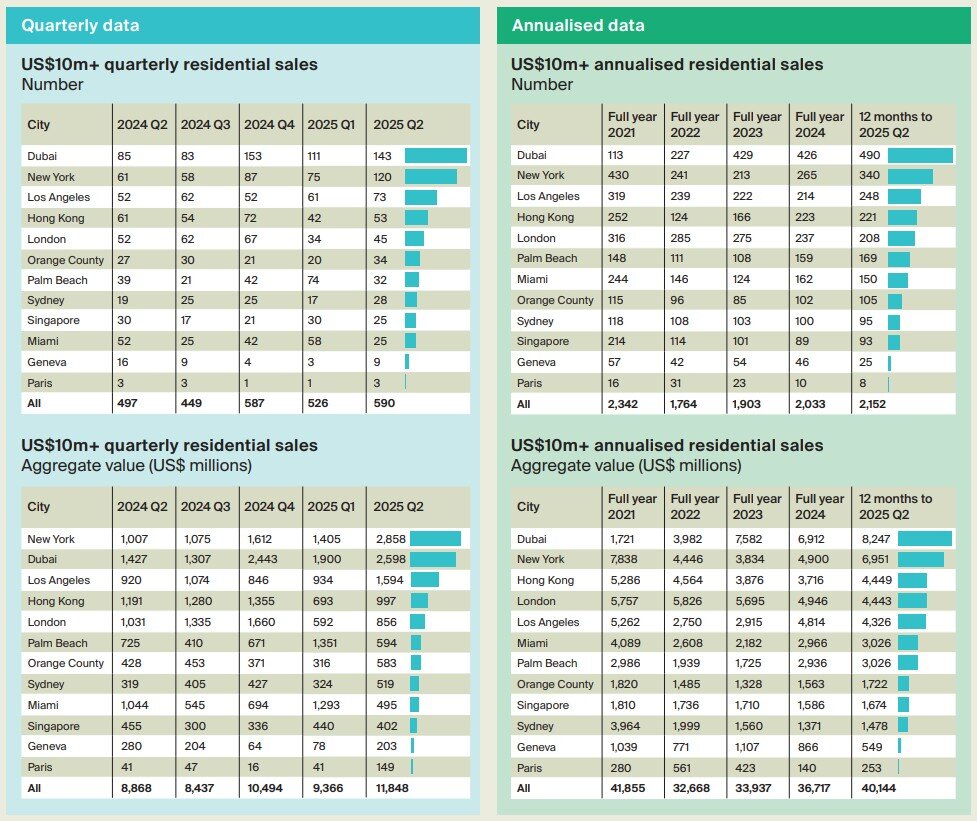

Global sales of super-prime homes–properties valued at $10 million and above–continued their upward momentum in the second quarter of 2025, according to international property consultancy Knight Frank. The firm recorded 590 transactions worldwide during the quarter, up 19% from 497 in the same period a year earlier. Total deal value grew even more sharply, rising 33% year-on-year to $11.8 billion from $8.9 billion.

City-by-City Highlights

Dubai led the world in transaction count, with 143 deals totaling $2.6 billion, reinforcing its position as the world’s deepest super-prime market. New York, meanwhile, registered 120 sales worth $2.9 billion, surpassing Dubai in total value for the first time since the end of 2021. The city’s resurgence has been fueled by strong demand for trophy condominiums and prime townhouse resales.

Los Angeles rebounded strongly from a slow start to the year, posting 73 transactions totaling $1.6 billion–its highest quarterly volume since Q1 2021. The surge was driven by high-end single-family homes in Beverly Hills and Malibu. Hong Kong also saw significant growth, with 53 deals totaling $1.0 billion, signaling that pent-up demand continues to materialize despite ongoing macroeconomic challenges.

London lagged behind, recording 45 transactions worth $0.9 billion, down 13% from Q2 2024 amid ongoing tax pressures. Still, activity improved from the first quarter, suggesting some buyers are capitalizing on softer pricing.

Looking Ahead

The global super-prime market faces a mix of opportunity and uncertainty. Proposed tariffs under President Trump remain a variable to watch, though so far capital flows and wealth creation appear resilient. In the U.K., continued tax pressures weigh on London’s market, even as lower prices attract overseas buyers.

Hong Kong’s luxury sector looks poised to sustain its revival into the second half of the year, despite broader economic headwinds. In Los Angeles, the Q2 rebound appears more than temporary, with anecdotal reports from agents and developers pointing to ongoing strong demand for prime single-family homes.

Liam Bailey

Yet the most notable story is New York’s comeback. After several muted years, the city’s super-prime sector is firmly reemerging and may challenge Dubai’s dominance by year-end.

“The global super-prime market continues to surprise on the upside,” said Liam Bailey, Global Head of Research at Knight Frank. “Dubai holds its lead, but New York’s resurgence and strong rebounds in Los Angeles and Hong Kong highlight the depth and diversity of demand. While investors will need to navigate a more complex macroeconomic environment, we expect momentum to be sustained.”