Atlanta, San Antonio and Jacksonville Leads the Nation in Contract Cancellations

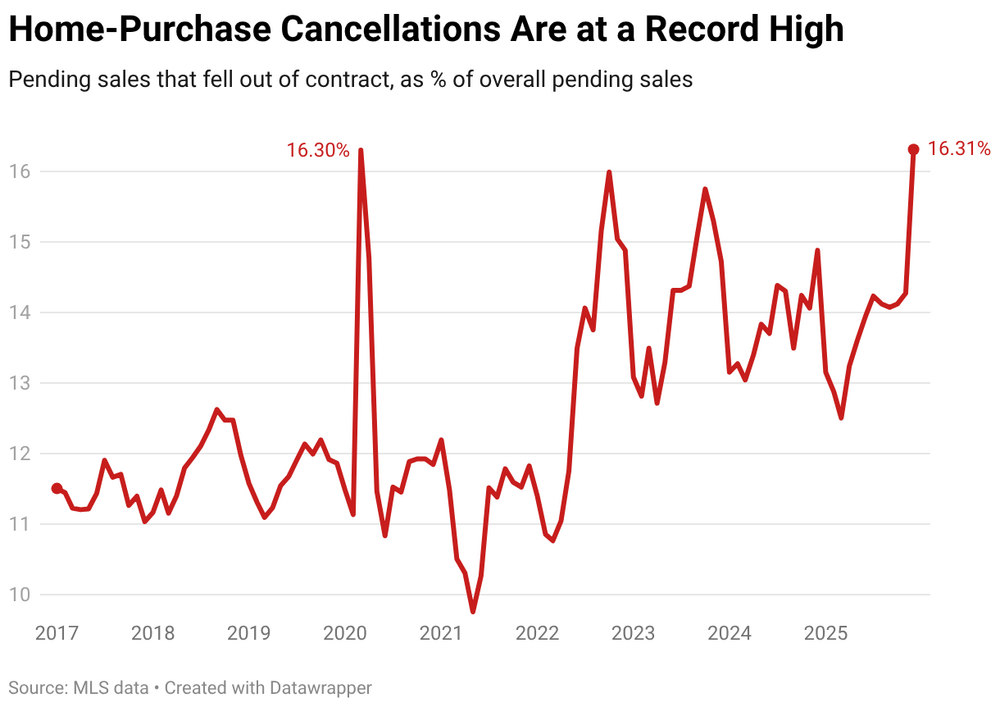

Homebuyers are backing out of purchase agreements at the fastest rate on record according to Redfin, underscoring the growing leverage buyers hold as high costs and swelling inventories reshape the housing market.

Roughly 40,000 U.S. home-purchase contracts were canceled in December 2025, representing 16.3% of homes that went under contract during the month, according to a Redfin analysis of multiple-listing-service data. The share rose from 14.9% a year earlier and marks the highest December cancellation rate since records began in 2017.

While contract activity is highly seasonal, December’s elevated fallout points to a market in transition. Sellers now outnumber buyers by a wide margin in many metros, giving purchasers greater flexibility–and less tolerance for price or property issues.

“High housing costs and rising inventory have made homebuyers more selective,” said Chen Zhao, Redfin’s head of economic research. “With buyers holding more negotiating power, many are willing to walk away if they think a better or more affordable option is available.”

Buyers most often exit deals through inspection contingencies. Structural or maintenance problems frequently trigger cancellations, though affordability pressures–particularly elevated monthly mortgage payments–remain a decisive factor, even when not explicitly cited.

There are signs of relief ahead. Mortgage payments have eased as rates have retreated from recent highs, and home-price growth is slowing. Redfin economists expect affordability to improve gradually in 2026 as wage gains begin to outpace housing costs.

Atlanta Leads the Nation in Cancellations

Atlanta posted the highest cancellation rate among major U.S. metros in December, with 22.5% of pending sales falling through, up from 19.6% in November. Jacksonville, Florida, and San Antonio followed at 20.6%, with Cleveland (20.2%) and Tampa (19.4%) rounding out the top five.

Redfin analyzed the 50 largest U.S. metro areas and included 47 with sufficient data. Atlanta first led the nation in cancellations in November and has rapidly shifted into a buyer’s market, with sellers now outnumbering buyers by more than 80%.

At the other end of the spectrum, cancellations were least common in Nassau County, New York (3.8%), San Francisco (4.2%), San Jose, California (8.9%), and New York City (10.5%).

Bay Area Sees Sharp Increases–From Low Levels

The largest year-over-year increases in cancellations were concentrated in California. San Jose posted the biggest jump, rising 6.8 percentage points to 8.9%, followed by Oakland (up 6.3 points to 11.3%), Sacramento (up 4.7 points to 17.9%), Atlanta (up 4.4 points), and Las Vegas (up 3.5 points to 19%).

After a dramatic pandemic-era boom, a sharp correction in 2022, and a renewed surge through late 2025, the Bay Area is settling into more balanced conditions.

“Buyers have options and aren’t shy about negotiating,” said Alison Williams, a Redfin Premier agent in Sacramento. “If a home is overpriced or has unresolved maintenance issues, many buyers will simply move on.”

Cancellations fell most sharply in Detroit, where the rate dropped 8 percentage points, followed by Warren, Michigan; Pittsburgh; Los Angeles; and Nassau County, New York–signaling that even in a cooling national market, local dynamics continue to diverge sharply.