For generations, homeownership in the U.S. was seen as a cornerstone of financial security — a hedge against rising rents and a way to lock in a fixed monthly payment. That promise is eroding.

Across the country, a growing number of homeowners are falling behind on their mortgages — not due to subprime lending or unsustainable purchases, but because of ballooning property taxes and insurance premiums. The fixed monthly payment that once anchored the American Dream has become a moving target.

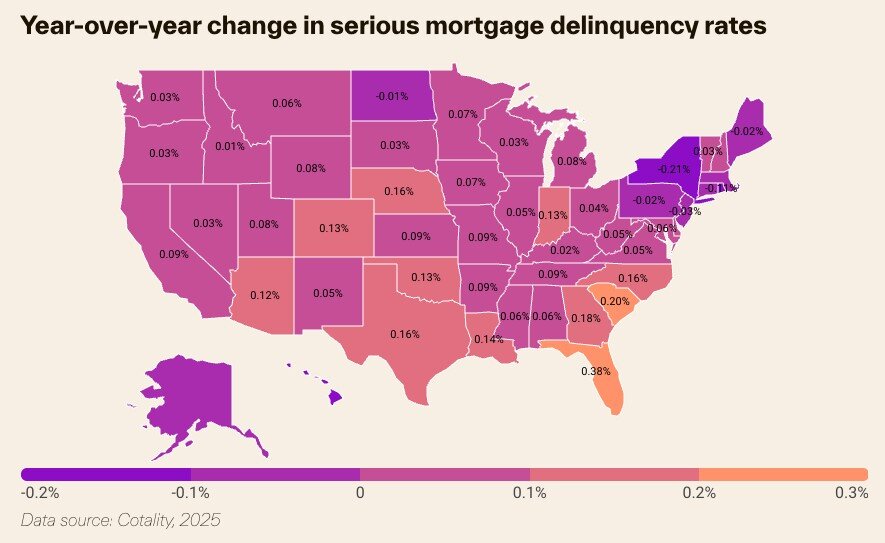

New data from housing analytics firm Cotality shows that serious mortgage delinquencies — loans overdue by 90 days or more — reversed their post-pandemic decline in mid-2024. Nearly half of all U.S. states saw delinquencies tick up, with sharp increases in Florida, South Carolina, and Georgia — states hit hard by natural disasters and skyrocketing insurance costs.

Florida has seen property taxes surge nearly 50% over the past five years, while average escrow payments — which include taxes and insurance — have jumped 62%. That’s in addition to a mortgage payment many borrowers had already stretched to afford. “It’s no longer about just affording a home,” said Cotality economist Archana Pradhan. “It’s about affording to stay in it.”

South Carolina lost 14 insurers between 2020 and 2023, thinning the market and pushing premiums higher. Georgia, meanwhile, saw average property tax bills rise by over $700 in just five years, while home prices rose 65% over the same period — shrinking the state’s long-standing affordability advantage.

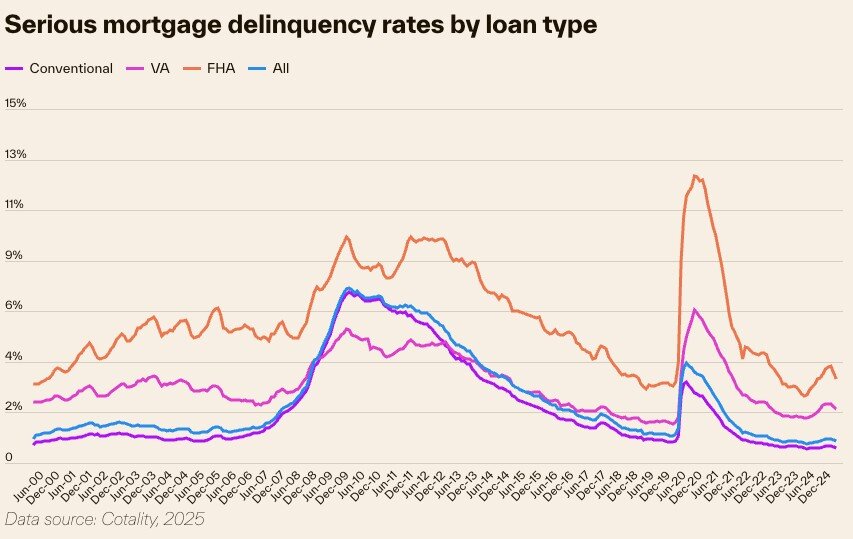

While higher-income borrowers often have reserves to weather cost increases, those using government-backed loans — like FHA or VA mortgages — are disproportionately at risk. These loans, designed to support low- and middle-income buyers with lower down payments, offer little cushion when costs escalate. According to Cotality, serious delinquency rates for FHA loans are five times higher than those of conventional mortgages; VA loan delinquencies are three-and-a-half times higher.

“These borrowers have the thinnest margins,” said Pradhan. “And when escrow costs spike, there’s nowhere to go.”

The broader trend paints a troubling picture. Nationally, property tax bills are up more than 15% since 2019. In Q1 2025, property tax delinquencies hit their highest level since 2018, with more than half of the states with the worst delinquency rates also reporting unemployment above the national average.

Mississippi now holds the nation’s highest overall delinquency rate. It also has the lowest median household income and ranks among the most hurricane-exposed states in the country, according to Cotality. Natural disasters are compounding the crisis: In Asheville, North Carolina, mortgage delinquencies rose 1% year-over-year after Hurricane Helene hit the region in 2024. The storm’s aftermath pushed up insurance costs — a burden that homeowners continue to bear long after the winds die down.

The net effect: homeownership is no longer the financial safe haven it once was. Rising escrow payments have destabilized monthly budgets and pushed more households to the brink. Those who bought homes under the assumption of long-term stability are finding themselves in an increasingly volatile reality.

“As costs rise, more families are being forced to choose between paying the mortgage and covering other essentials,” said Pradhan. “And for some, the only option left is to walk away.”

That shift carries broader implications for the housing market. When mortgage payments become unpredictable, the appeal of ownership fades. Renters hesitate to buy. Owners slip into delinquency. Inventory patterns distort. And housing — once a bedrock of middle-class wealth — begins to look more like a liability than an asset.

The traditional pitch to homebuyers was simple: lock in your housing costs and build equity over time. But when taxes and insurance are spiking year after year, that equation breaks down. A fixed-rate mortgage doesn’t mean fixed costs anymore — and without predictability, the long-standing value proposition of homeownership is coming undone.