Condo Prices and Demand Crumble in Florida and Texas

Based on new Redfin data, the U.S. condominium market is unraveling faster than any other segment of the housing sector, as rising costs and tighter financing rules push buyers to the sidelines and sellers flood the market.

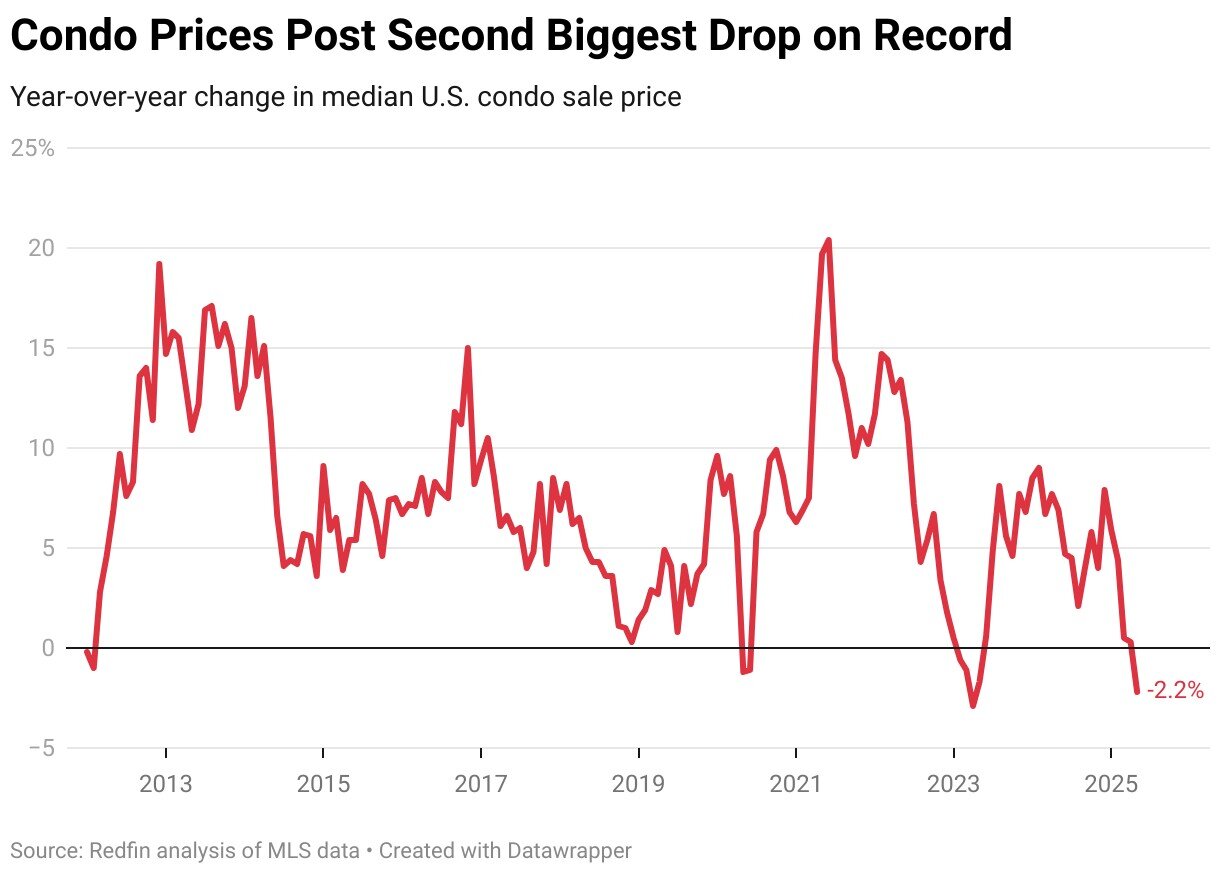

The median sale price of a U.S. condo fell 2.2% year-over-year to $354,100 in May, marking the second-steepest annual drop since Redfin began tracking the data in 2012. Only April 2023 posted a deeper decline, when prices plunged 2.9% following a pandemic-era market peak.

Unlike that earlier decline, today’s slump isn’t about market normalization–it’s about imbalance. There are now roughly 80% more condo sellers than buyers, according to Redfin. Surging insurance premiums, soaring homeowners’ association (HOA) dues, and a wave of special assessments are driving current owners to exit, while deterring new buyers from stepping in.

“It’s a slow housing market across the board, but condos have been hit particularly hard,” said Aditi Jain, a Redfin Premier agent in Boston. “Many condo associations don’t allow FHA loans, which is cutting off a big segment of potential buyers. Two of my clients had to walk away from deals because they couldn’t secure financing.”

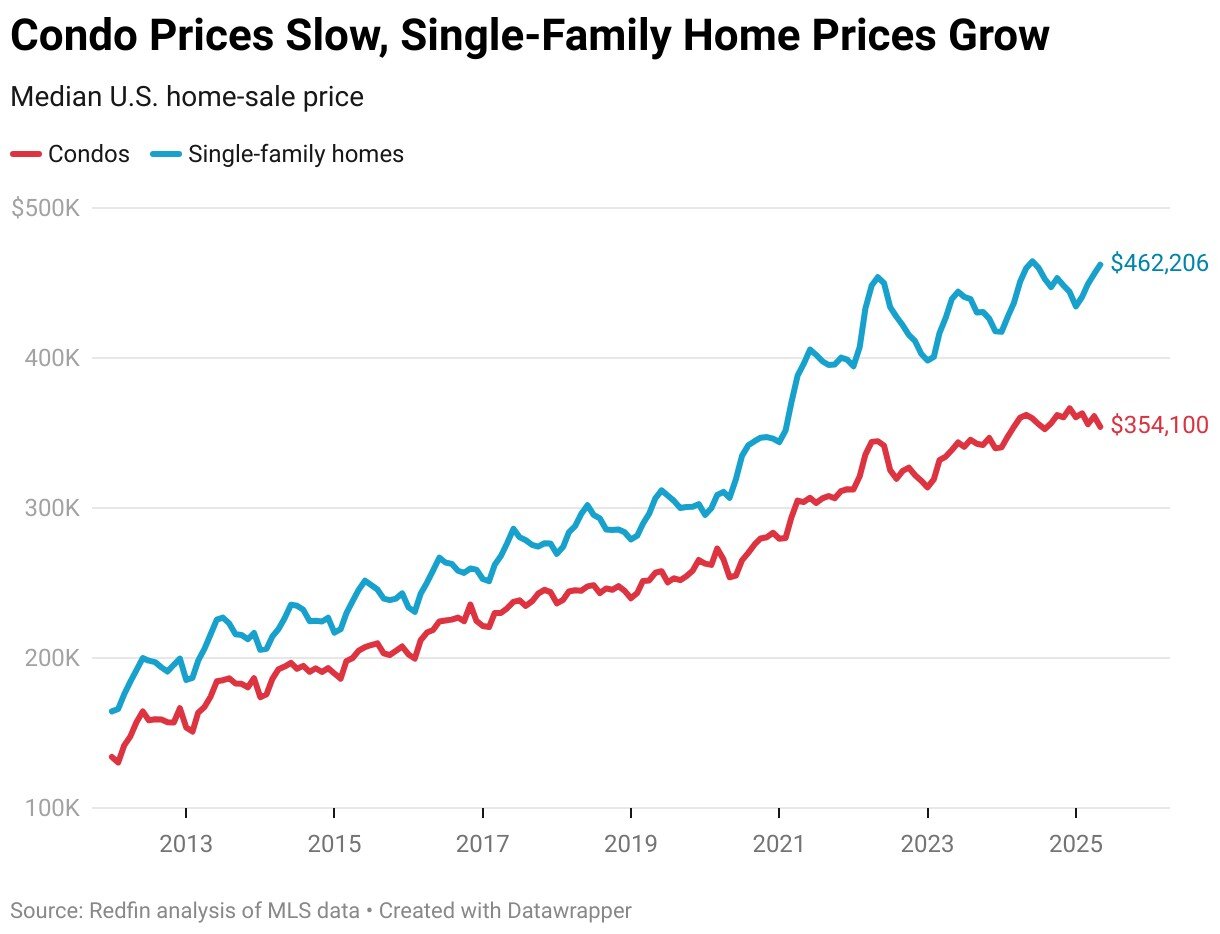

While the broader U.S. housing market is softening, the condo sector is falling at a faster clip. Single-family home prices still eked out a 0.5% gain in May to a median of $462,206–marking the slowest growth in nearly two years, but growth nonetheless.

Sales Plunge and Listings Pile Up

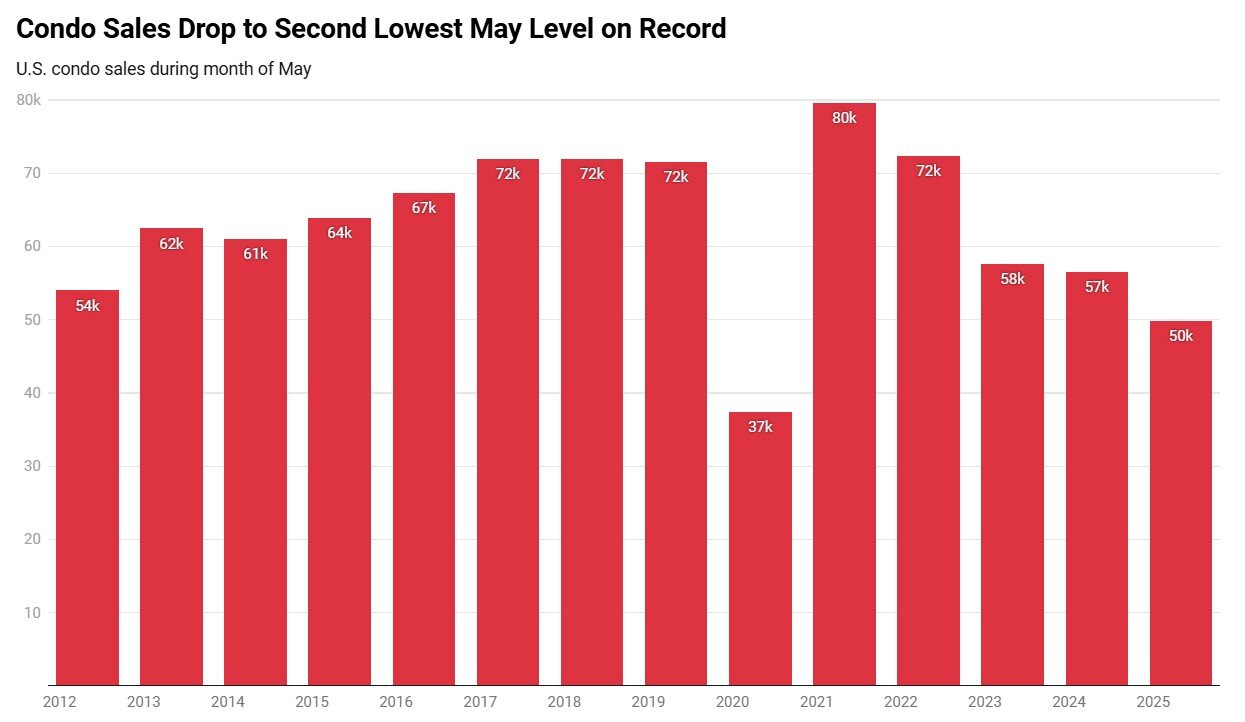

Sales of condos plunged 11.9% year-over-year in May–the steepest decline since June 2024 and more than triple the 3.7% drop in single-family home transactions. For condos, it was the second-lowest May sales volume on record, only narrowly beating the pandemic freeze of 2020.

Condo inventory is ballooning as units sit unsold. Active listings climbed to a 10-year high last month, in contrast with single-family listings, which reached their highest level since 2019. The typical condo now spends 46 days on the market, the slowest pace for any May since 2015, and a full week longer than a year ago. Single-family homes sold faster, at a median of 38 days–still sluggish by historical standards.

Prices and Demand Crumble in the Sunbelt

The deepest cracks are appearing in Florida and Texas–two Sun Belt states that led the pandemic housing boom and are now paying the price, says Redfin.

In Deltona, FL, median condo prices collapsed 32.2% year-over-year, the sharpest drop among 66 major metro areas analyzed by Redfin. Similar double-digit declines hit Crestview, FL (-32%), Houston (-23%), Oakland (-20.3%), and Tampa (-19%). Of the 10 metros with the largest price declines, seven were in Florida and two in Texas.

Sales followed a similar pattern. Dallas condo transactions dropped 33.3%, while Palm Bay, FL (-32.8%), Phoenix (-32.7%), Port St. Lucie, FL (-31.5%), and Orlando (-31%) all saw major declines. Seven of the 10 worst-performing condo sales markets were in Florida.

Rising HOA fees and insurance costs–fueled by natural disaster risks, stricter building regulations, and the lingering aftermath of the Surfside condo collapse in 2021–have driven buyers away. In Florida, new laws requiring structural inspections and reserve funding have triggered a wave of fee hikes and special assessments across condo associations.

Bright Spots in the East

While much of the country sees condo values retreat, parts of the Northeast are bucking the trend. New Brunswick, NJ led all metros with a 14.9% jump in median condo prices, followed by Montgomery County, PA (14.1%), Pittsburgh (14.1%), San Francisco (8.8%), and Ocean City, NJ (8.2%). A persistent supply crunch in many Eastern markets is helping to sustain price growth.

Sales were also strongest in the East and Midwest, with Indianapolis posting a 27.3% surge in condo transactions. Portland, ME (19.2%), Charleston, SC (11.5%), Montgomery County (10.8%), and Ocean City (8.4%) rounded out the top five.

Concessions on the Table

As prices soften and properties linger on the market, more sellers are offering price cuts and concessions, says Redfin. For opportunistic buyers, especially in oversupplied markets, the condo downturn could be a chance to negotiate a deal–provided they can stomach the fees and insurance premiums that come with the keys.