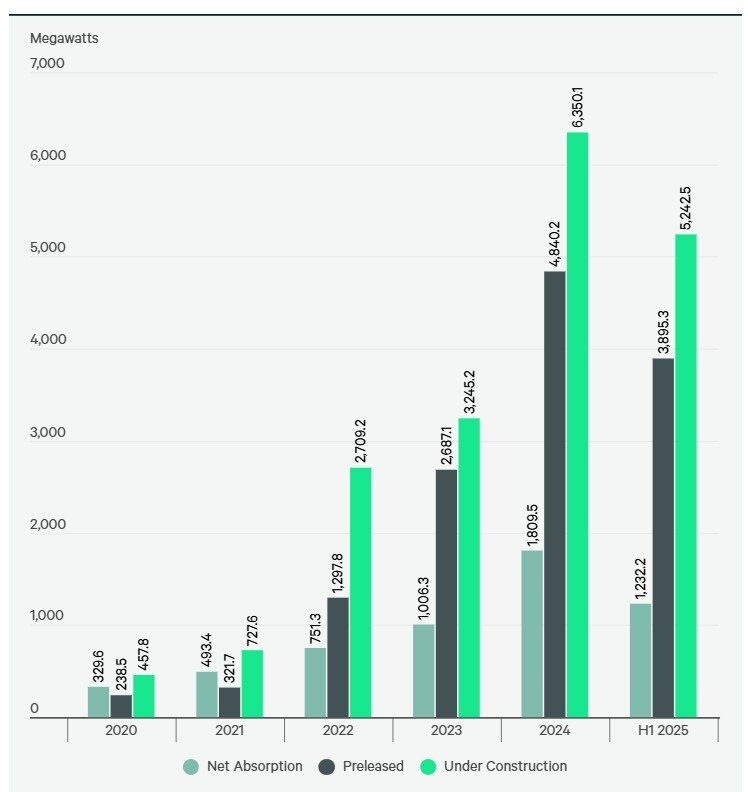

Fueled by a surge in artificial intelligence and cloud computing demand, North America’s data center market continued its blistering pace of expansion in the first half of 2025 — but growth is running headlong into the limits of available power and infrastructure, according to new data from CBRE.

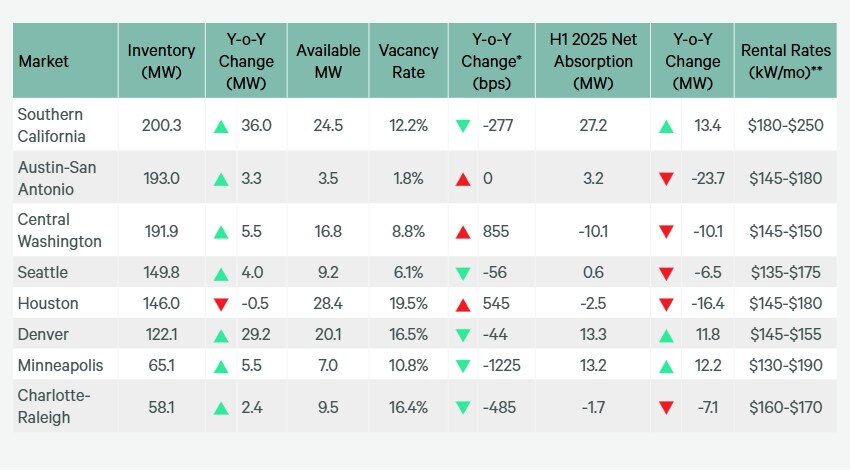

Total primary market supply increased by 17.6% during the first six months of the year, yet capacity remains scarce. Despite a record-high 8,155 megawatts (MW) of supply in operation, vacancy rates fell to an all-time low of just 1.6%. CBRE reports that roughly three-quarters of the capacity currently under construction — about 74.3% — is already preleased, primarily to cloud and AI firms securing infrastructure years in advance.

“The market is tight, and it’s going to stay that way,” said a CBRE executive. “The biggest constraint now is power availability, not real estate.”

Rising Prices and Power Constraints

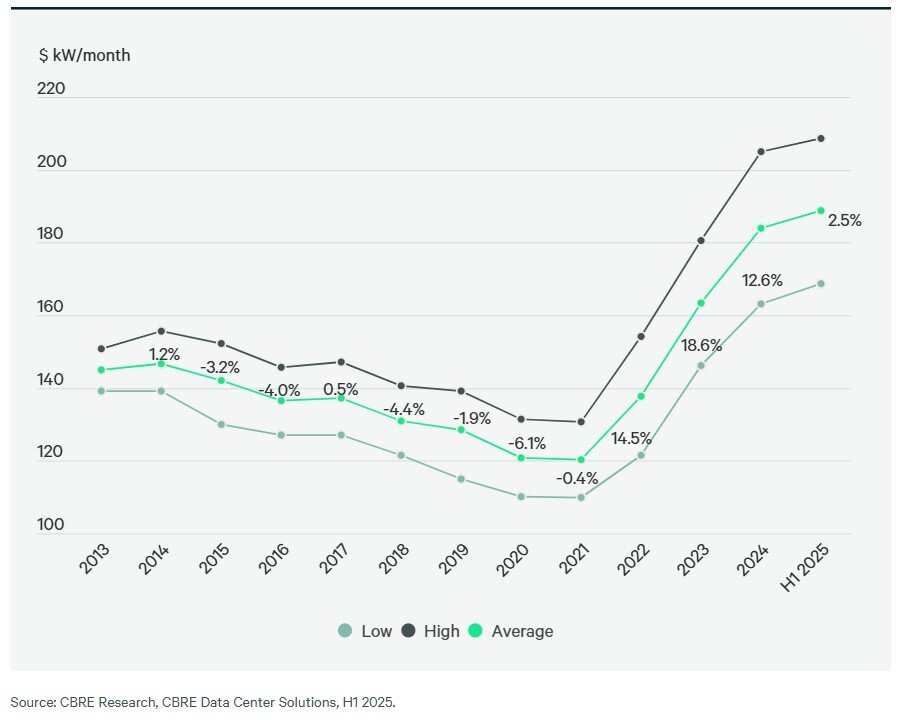

Data center pricing continues to climb alongside demand. Average rates for mid-sized requirements of 250 to 500 kilowatts (kW) rose 2.5% in the first half of 2025, extending a steady upward trajectory. Larger deployments, however, saw far sharper increases. Lease rates for 10 MW or greater rose by as much as 19% in several major markets, as hyperscale users and AI infrastructure providers competed for high-density contiguous capacity.

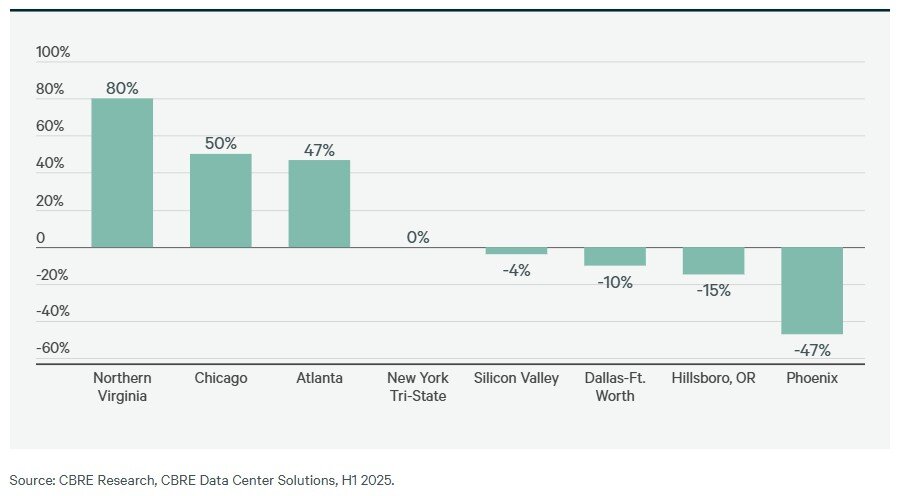

Northern Virginia — still the largest and most active data center market in the world — recorded a 13.8% increase in pricing for 10 MW-plus deals since year-end 2024. Silicon Valley experienced the steepest escalation, up 19% amid severe power shortages and surging AI-related demand. Chicago followed with a 15.4% gain, driven by a lack of large, power-ready sites and mounting delays in power delivery timelines.

The widening gap between small and large deployments underscores a shifting landscape. AI and hyperscale tenants are increasingly dictating market pricing as they seek scalable, future-proofed capacity across core and secondary markets.

Investment Slows but Capital Interest Remains High

Investment in North American data centers slowed sharply in the first half of 2025, totaling less than $1 billion — more than 50% below year-earlier levels. CBRE attributes the decline to investor caution amid economic uncertainty, geopolitical tensions, and mounting power supply challenges.

Yet institutional interest in the sector remains robust. Investors who traditionally favored industrial or net-lease assets have pivoted toward data centers as alternative plays, drawn by strong underlying fundamentals. Analysts expect investment activity to rebound in the second half of the year as deferred transactions close and new large-scale developments come to market.

Financing activity, meanwhile, has accelerated. Issuance of commercial mortgage-backed securities (CMBS) backed by data centers reached a record $4.5 billion in the first quarter of 2025, led by Switch’s $2.4 billion securitization of three Nevada properties and QTS’s $2.05 billion deal involving assets in Virginia and Georgia.

Other major capital moves are reshaping the landscape. Roughly $7 billion in CoreWeave-leased financings have been completed in recent months, primarily for build-to-suit projects. Principal Financial raised $3.64 billion for a new data center growth and income fund — designed to finance more than $8 billion in hyperscale developments through a partnership with Stream Data Centers. Blue Owl Capital acquired IPI Partners’ investment management business for $1 billion, adding over $10 billion in digital infrastructure assets to its portfolio. And DigitalBridge, in partnership with Canada’s Caisse de dépôt et placement du Québec, acquired hyperscale developer Yondr Group in a deal underscoring consolidation across the sector.

Even larger ambitions loom. OpenAI, Oracle, and SoftBank jointly announced “Project Stargate,” a $500 billion global initiative aimed at building next-generation AI infrastructure.

Valuations, Power, and the Push for Renewables

Rents for both existing and build-to-suit facilities continue to rise, propelled by tight power supplies and higher land, construction, and capital costs. Tariffs on imported materials have further squeezed development budgets. Despite the cost inflation, capitalization rates have remained largely stable, typically hovering 100 to 150 basis points above the 10-year Treasury yield, as investor appetite continues to outstrip supply.

Markets with access to reliable power within 18 to 36 months are commanding the most attention. Pennsylvania has emerged as a new hot spot thanks to its abundant electricity and proximity to the New York Tri-State and Northern Virginia regions. Developers and hyperscale users alike are now prioritizing large tracts of land capable of supporting more than 200 MW of capacity.

In parallel, many operators are rethinking energy sourcing. Some cryptocurrency miners have redirected power allocations toward data center development, while new projects increasingly include on-site generation — from gas-fired plants and photovoltaic solar arrays to battery storage systems. Small modular nuclear reactors (SMRs) are expected to enter the mix before the end of the decade.

Renewable energy integration is also accelerating. CBRE notes that developers are embracing solar, wind, geothermal, and modular nuclear solutions as part of a broader effort to de-risk power strategies and meet long-term sustainability goals.

As AI and cloud workloads expand at breakneck speed, the industry’s biggest challenge may no longer be finding land or capital — but finding the power to keep the world’s digital economy running.