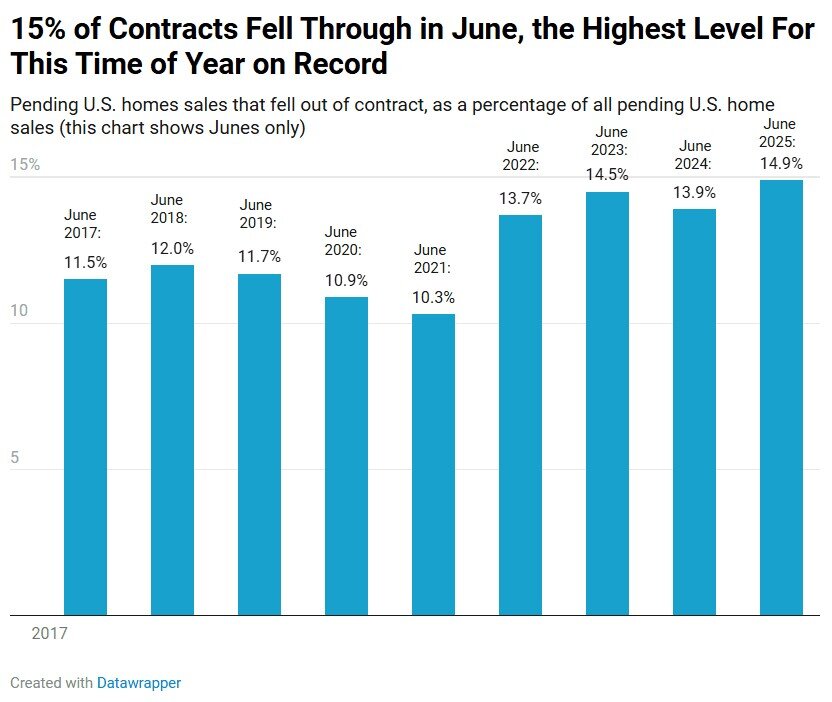

The U.S. housing market is experiencing a sharp uptick in home sale cancellations, with nearly 15% of all contracts signed in June falling through — the highest share for any June since at least 2017, according to new data released by Redfin.

Just over 57,000 pending home sales were scrapped last month, representing 14.9% of homes that went under contract. That’s up from 13.9% a year ago, as elevated home prices, economic uncertainty, and a growing supply-demand imbalance shift power back to buyers.

With a surplus of sellers and limited demand, the U.S. housing market has firmly tilted into buyer’s market territory. That leverage is giving prospective homeowners more room to negotiate — or walk away entirely.

“Buyers are being more selective and more strategic,” said Crystal Zschirnt, a Redfin Premier agent in Dallas. “If a better home pops up or an inspection reveals costly repairs, they’re out. Some are also sitting tight, betting that prices or mortgage rates will fall further.”

While mortgage rates have edged down slightly in recent months, they remain stubbornly high, hovering around 6.8%. Meanwhile, home prices remain near record levels, straining affordability and driving some would-be buyers to reconsider.

Redfin projects national home prices to dip by 1% year-over-year by the end of 2025, with interest rates likely to remain rangebound.

Economic Jitters and Sticker Shock Fuel Dropouts

Beyond home inspections and buyer indecision, financial and macroeconomic concerns are playing an outsized role in rising cancellation rates. Would-be buyers are backing out after seeing final mortgage payment calculations — or amid worries about inflation, tariffs, and a potential recession.

Some agents report that buyers are getting cold feet even late in the process. “They’re doing the math and realizing the monthly cost just doesn’t add up,” said one Redfin agent. “Others are watching headlines and deciding to wait.”

Sellers, meanwhile, are becoming increasingly flexible — a notable reversal from the hypercompetitive pandemic-era market.

“Sellers today are doing whatever they can to keep deals alive,” said Van Welborn, a Redfin Premier agent in Phoenix. “I had one luxury buyer uncover a septic issue and negotiate a $1 million price reduction.”

Sun Belt Cities Lead in Scrapped Sales

The highest contract cancellation rates were concentrated in the Sun Belt, where new construction is booming and homeowners are grappling with surging insurance costs due to climate risk.

Jacksonville, FL topped the list with 21.4% of home deals falling through in June, followed closely by Las Vegas (19.7%) and Atlanta (19.6%). Rounding out the top 10 were San Antonio, Tampa, Orlando, Riverside, Phoenix, Fort Worth, and Miami — all markets with a glut of inventory and volatile weather-related insurance premiums.

In contrast, Northeast metros had the lowest cancellation rates. Nassau County, NY reported just 5.4% of deals falling through, the lowest among the 44 markets tracked. Montgomery County, PA (6.8%) and Milwaukee (8.2%) followed.

Cancellations Up in Most Markets

Of the 44 major metros analyzed by Redfin, all but seven saw a year-over-year increase in canceled contracts. Anaheim, CA saw the biggest jump, with cancellations rising to 15.2% from 12.6%, while Los Angeles climbed to 17.1% from 14.7%.

A few cities saw slight declines. Fort Lauderdale posted the largest drop, from 17.7% to 16.5%, followed by Denver and Orlando.

As the U.S. housing market continues to recalibrate, volatility remains the only constant. With affordability strained, mortgage rates elevated, and economic clouds looming, buyers are approaching deals with increased caution — and an eye toward leverage.