Homebuyer Activity Picks Up Pace in Mid-September

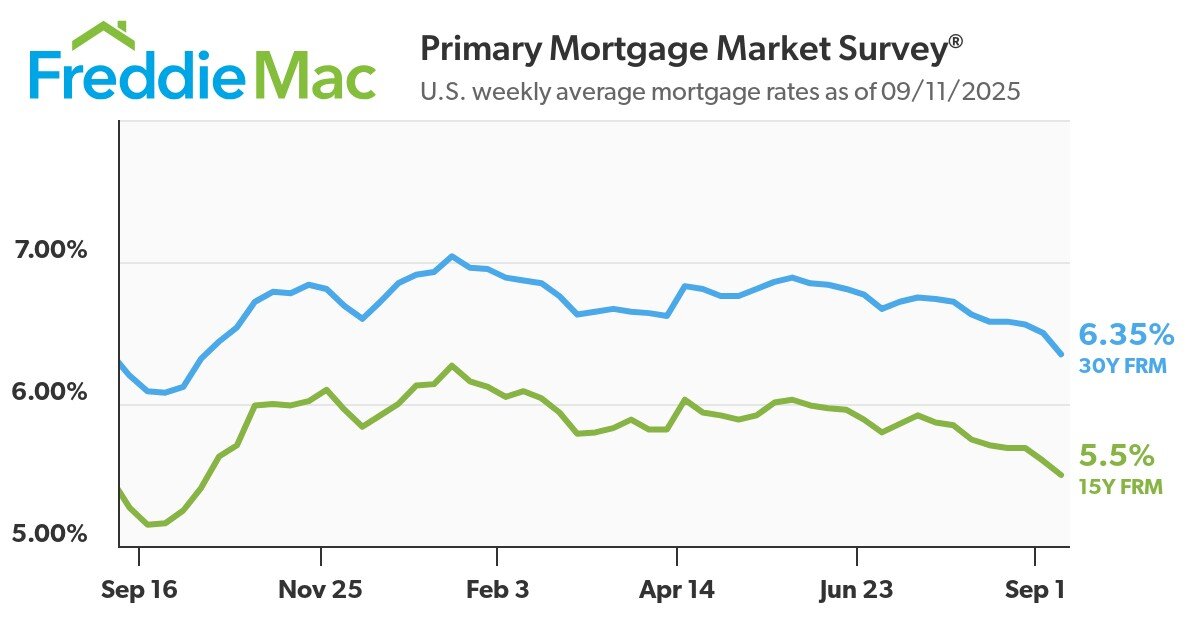

U.S. mortgage rates tumbled this week, posting their largest weekly decline in more than a year and providing a boost to prospective homebuyers. According to Freddie Mac’s latest Primary Mortgage Market Survey, the average 30-year fixed-rate mortgage fell to 6.35%, down from 6.50% the previous week, marking the most significant single-week drop since at least September 2024.

Sam Khater

The 15-year fixed-rate mortgage followed a similar trend, declining to 5.50%, from 5.60% one week earlier. Freddie Mac’s Chief Economist Sam Khater said the movement indicates a positive shift for the housing market. “Mortgage rates are headed in the right direction and homebuyers have noticed,” Khater said, citing the surge in purchase applications to their highest year-over-year growth level in more than four years.

Rates in Historical Perspective

While the recent declines are notable, borrowing costs remain slightly higher than they were at the same point last year. In September 2024, the 30-year fixed rate averaged 6.20%, while the 15-year fixed rate stood at 5.27%. Analysts say that although rates have eased from their mid-2025 peaks, they have yet to return to the historically favorable levels seen in mid-2024.

The pullback in rates aligns with broader trends in the bond market. Long-term Treasury yields, which heavily influence mortgage pricing, have retreated amid signs of slowing economic growth, including softer job market data. Expectations of potential monetary easing by the Federal Reserve have also contributed to lower borrowing costs.

Market Impact and Outlook

The recent rate decline is already having tangible effects on housing demand. Home-purchase applications have surged, signaling that buyers who were previously deterred by higher interest rates are re-entering the market. This uptick could help mitigate the slowdown in home sales and constrained inventory that has characterized much of 2025.

However, affordability challenges remain. Rising home prices, combined with steep down payments and monthly carrying costs, continue to strain prospective buyers’ budgets, even with lower rates. Economists note that future movements in mortgage rates will depend heavily on upcoming economic indicators, including inflation reports, labor market conditions, and Federal Reserve policy decisions. The next Federal Open Market Committee meeting will be closely watched for signals on the direction of interest rates.

Bottom Line

Freddie Mac’s latest data suggest that U.S. mortgage rates are easing after months of elevated costs, providing a modest reprieve to buyers and refinancers. The 30-year fixed mortgage at 6.35% and the 15-year fixed at 5.50% offer some relief, but broader affordability issues mean that homeownership remains challenging for many Americans in the current market.