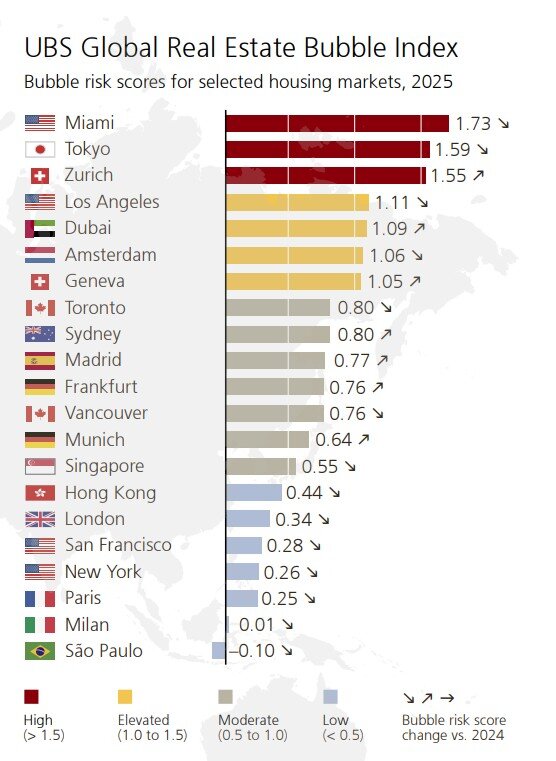

Miami tops investment banker UBS’s latest Global Real Estate Bubble Index, marking it as the world’s riskiest urban housing market. Tokyo and Zurich follow closely, while Los Angeles, Dubai, Amsterdam, and Geneva are also flagged for elevated bubble risk, according to the Swiss bank’s annual report.

In contrast, markets including Singapore, Sydney, Vancouver, and Toronto fall into the moderate-risk category. European cities such as Madrid, Frankfurt, and Munich share a similar profile. Cities with lower risk, UBS reports, include London, Paris, Milan, Hong Kong, San Francisco, New York, and São Paulo, with the latter showing the most restrained housing-market exposure among the 50 major cities analyzed.

Global Cooling, But Local Booms Persist

The report finds that over the past year, global housing markets have broadly cooled. Price-to-rent ratios declined across Europe and Asia, except in Tokyo, while subdued mortgage lending reflects persistently high financing costs. Despite a gradual easing of interest rates since 2023, borrowing costs remain roughly double the 2020-2022 range. Residential construction continues to lag, exacerbating shortages in growing urban areas. Overall, UBS notes, the average bubble risk in major cities has declined for the third consecutive year.

Toronto and Hong Kong registered the largest drops in bubble-risk scores, while imbalances in Miami and Tokyo, though still elevated, have moderated compared with last year. By contrast, Dubai and Madrid have seen sharp increases. Dubai’s market, buoyed by strong economic growth since 2022, now appears increasingly overheated.

Decoupling from Fundamentals

Markets with elevated or high bubble risk have increasingly diverged from economic fundamentals over the past five years. Inflation-adjusted home prices in these cities rose nearly 25% on average, while rents increased only 10% and incomes roughly 5%. By comparison, cities with moderate or low risk saw price declines of about 5%, with rents and wages largely flat. Historically, UBS notes, such gaps between prices, rents, and income often precede housing crises.

“Price bubbles are a recurring feature of property markets”, says UBS. “They reflect substantial and sustained mispricing, which is only evident in retrospect. Patterns of excess typically include a disconnect between prices and local incomes or rents, and imbalances such as excessive lending or construction. Our index measures these risks, but it does not predict the timing of corrections.”

Interest Rates and Urban Shifts

Over the past four quarters, global home prices were largely flat in inflation-adjusted terms, with Eurozone cities showing minimal growth. North American markets slowed sharply, weighed down by affordability constraints. Exceptions include Madrid, which recorded 14% real price growth; Dubai, up 11%; and Tokyo, growing more than 5%. Swiss cities Zurich and Geneva also saw modest gains supported by near-zero interest rates.

Over the past five years, Dubai and Miami led global price growth, with cumulative gains of roughly 50%. Tokyo and Zurich followed with 35% and nearly 25%, respectively. Meanwhile, Hong Kong, Paris, London, Munich, and Frankfurt posted double-digit declines. UBS attributes the divergence to two forces: post-pandemic migration to suburbs driven by flexible work, and higher interest rates limiting affordability, especially in dense urban cores.

Looking ahead, demographic shifts and continued overseas demand may reverse these trends. Aging populations in Europe could concentrate growth in cities, while foreign buyers have driven recent booms in Tokyo, Madrid, Miami, and Dubai. Conversely, new taxes, purchase restrictions, and tighter regulations have dampened demand in Vancouver, Sydney, Paris, Singapore, and London.

Affordability Pressures Mount

For skilled service workers, purchasing even a modest 60-square-meter apartment is now financially out of reach in most global cities. Hong Kong remains the least affordable, requiring roughly 14 years of average income for such a unit. Price-to-income ratios exceed 10 in Paris, London, and Tokyo, and local wages are insufficient in Zurich, Sydney, Geneva, Munich, and São Paulo. Rising mortgage rates and shorter amortization schedules have further constrained buying power, shrinking the affordable living space for many workers by roughly 30% since 2021.

Price-to-Rent Dynamics

Price-to-rent ratios, which indicate how many years of rent it takes to purchase a home, have declined over the past three years across Europe and Asia, except Tokyo. Zurich now tops the global list, followed by Munich and Geneva, with Frankfurt, Tokyo, and Hong Kong near similarly high multiples. Elevated ratios, UBS notes, reflect speculative demand and expectations for outsized price gains during years of low interest rates.

Conversely, Dubai, São Paulo, and major U.S. cities have some of the lowest price-to-rent ratios, due to lightly regulated rental markets, higher interest rates, and risk premiums in Dubai and São Paulo.

A Cautious Outlook

UBS concludes that housing remains an attractive store of value amid high global debt and ongoing inflationary pressures, provided policy rates ease and economic growth remains resilient. Limited supply in most major cities supports continued price gains, but risks remain sensitive to inflation trends, monetary policy, and shifts in investor sentiment.